The company registration landscape in Nepal has undergone a significant transformation with the introduction of the Company and Management Information System (CAMIS).

This modernised online platform has streamlined the entire registration process, making it faster, more transparent, and accessible to both local entrepreneurs and foreign investors.

This comprehensive guide provides detailed, point-wise steps to help you navigate the company registration process efficiently.

Understanding CAMIS: The Digital Registration Platform

The Office of Company Registrar (OCR) introduced CAMIS as a centralised digital platform to modernise company registration and management in Nepal.

This system operates under the legal framework of the Companies Act 2063 (2006) and its subsequent amendments.

CAMIS offers several advantages, including real-time tracking of application status, reduced processing time through automated workflows, minimised human error through standardised forms, secure document storage, and easier compliance with ongoing reporting requirements.

Types of Companies You Can Register

Before beginning the registration process, determine which type of business structure best suits your needs.

- Private Limited Company – It remains the most popular choice for small and medium-sized enterprises. It requires a minimum of one shareholder and can have up to 101 shareholders. The liability of members is limited to the amount unpaid on their shares. These companies cannot offer shares to the general public and face fewer regulatory burdens compared to public companies.

- Public Limited Company – It is designed for larger businesses that intend to raise capital from the public through share offers. These entities must have at least seven shareholders with no upper limit. They can list their shares on the Nepal Stock Exchange but face stringent disclosure requirements and greater regulatory oversight.

- Partnership Firm – It involves two or more individuals who agree to share profits and losses. General partnerships impose unlimited liability on all partners, whilst limited partnerships allow some partners to limit their liability to their capital contribution.

- Sole Proprietorship – It is the simplest business structure, owned and controlled by a single individual. Whilst easy to establish with minimal formalities, sole proprietorships offer no separation between personal and business assets.

- Branch Office and Liaison Office – They allow foreign companies to establish a presence in Nepal. Branch offices can conduct commercial activities and generate revenue, whilst liaison offices serve purely representative functions without engaging in profit-making activities.

Eligibility Criteria for Company Registration

Any Nepalese citizen who has attained the age of 18 can register with a company without restrictions.

Foreign individuals and companies can establish businesses in Nepal, subject to the provisions of the Foreign Investment and Technology Transfer Act.

Certain sectors remain restricted or prohibited for foreign investment, whilst others allow foreign participation with specific approval from relevant authorities.

Private limited companies require at least one director, whilst public limited companies need a minimum of three directors.

All directors must be natural people aged 18 years or above. At least one director must be a resident of Nepal.

For private companies, a minimum of one shareholder suffices, who may also serve as the sole director.

Public companies are required to have at least seven shareholders at the time of incorporation.

Step-by-Step Company Registration Process Through CAMIS

Step 1: Create Your CAMIS Account

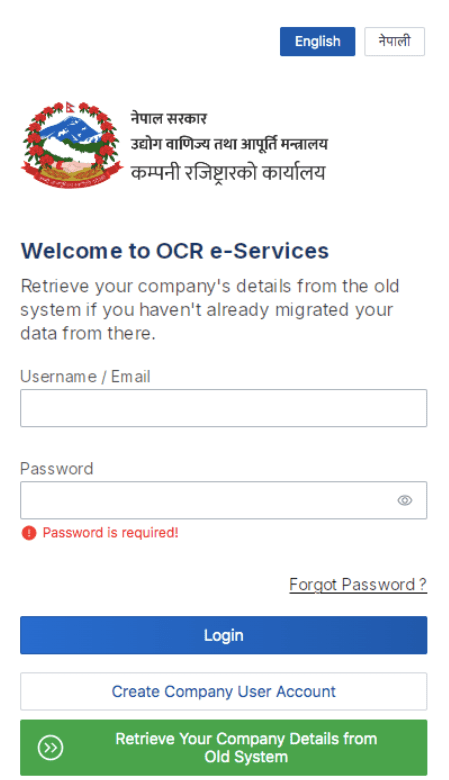

- Visit the CAMIS portal and register as a new user.

- Verify your account via email and OTP.

- Complete your profile and upload a photo and ID.

Step 2: Check Name Availability and Submit Reservation Application

- Search your proposed company name in English and Nepali.

- Ensure the name follows OCR rules and prepare 3+ alternatives.

- Submit the reservation form with business activity details.

- Upload required documents and pay the name reservation fee.

Step 3: Prepare Constitutional Documents

- Draft Memorandum of Association (MOA) with company details, objectives, and shares.

- Draft Articles of Association (AOA) for internal management rules.

- Print both documents on the correct stamp paper and sign with each witness.

Step 4: Complete the CAMIS Registration Application

- Fill in company information, share capital, promoters, directors, and shareholders.

- Upload scanned documents, photos, and director’s consent letters.

- Verify all uploaded documents before submission.

Step 5: Pay Registration Fees and Submit Application

- Review automatically calculated fees.

- Make online payment via bank, mobile app, or digital wallet.

- Save the payment receipt, and the application is automatically submitted to OCR.

Step 6: Track Application and Respond to Queries

- Monitor application status on CAMIS.

- Respond promptly to any queries raised by OCR with the required documents.

Step 7: Complete Physical Verification

- Receive notice to submit original documents.

- Schedule an appointment and bring original documents.

- OCR verifies documents and receives preliminary confirmation.

Step 8: Receive Certificate of Incorporation

- After final approval, download the digital certificate.

- Collect a physical certificate if needed.

- Verify all details on the certificate.

Step 9: Obtain Permanent Account Number (PAN)

Within the timeframe specified by tax legislation, register your company with the Inland Revenue Department to obtain a Permanent Account Number.

Visit the IRD portal and complete the PAN registration form with your company details. Upload your Certificate of Incorporation and other required documents, such as the Memorandum and Articles, the citizenship documents and the NID of directors and proof of registered office.

After processing your application, the IRD issues your PAN, which must be displayed on all tax returns, invoices, and official correspondence with tax authorities.

Step 10: Register for Value Added Tax (If Applicable)

If your business activities fall within VATable categories or if your annual turnover exceeds the mandatory registration threshold, you must register for VAT.

Through the IRD portal, complete the VAT registration application. Provide details about your business activities, expected turnover and tax period preference.

After approval, the IRD issues your VAT registration certificate, which includes a unique VAT number.

Step 11: Open a Company Bank Account

Select a bank that offers suitable business banking services. Banks require several documents to open a company account, including a Certificate of Incorporation, Memorandum and Articles of Association, a PAN certificate, a board resolution authorising account opening, specimen signatures of authorised signatories, citizenship documents and NID of authorised signatories, and proof of a registered office.

Schedule an appointment with the bank’s business banking department and complete the account opening forms.

Deposit the required paid-up capital into the company’s bank account if it has not already been fully paid.

Step 12: Obtain Necessary Business Licenses

Depending on your business activities, you may need various sector-specific licenses or permits.

Common requirements include industrial registration from the Department of Industry for manufacturing, import/export licenses from the Department of Commerce for trading, operating licenses from relevant ministries for regulated sectors and municipal permits from local authorities for operating business premises.

Each licensing authority has its own application process, and many now offer online application systems.

Maintain a compliance calendar tracking renewal dates and reporting requirements for all licenses and permits.

Step 13: Establish Proper Corporate Governance

Conduct your first board meeting within a reasonable time after incorporation.

This meeting typically covers the appointment of key officers, such as the company secretary and the chief executive; authorisation of bank account opening; approval of the company seal design; adoption of accounting policies and the fiscal year; delegation of operational authorities; and approval of initial contracts.

Record comprehensive minutes of the meeting and file them in the statutory registers maintained at the registered office.

Establish proper accounting records from day one as required by the Companies Act. Essential records include a cash book that records all receipts and payments, a journal for accounting entries, ledger accounts for all transactions, and stock registers dealing with inventory.

Consider using accounting software to streamline record-keeping and engage a chartered accountant or qualified bookkeeper to establish a proper accounting system.

Special Considerations for Foreign Investment

Foreign investors establishing companies in Nepal must navigate additional requirements. Before proceeding with company registration, foreign investors typically need approval from the Department of Industry.

Prepare a detailed project proposal outlining the business activities, investment amount, technology transfer arrangements (if applicable), employment generation plans, and economic benefits for Nepal.

Certain sectors require additional approvals from regulatory ministries. Banking and financial services require approval from Nepal Rastra Bank, telecommunications require clearance from the Ministry of Communications, and energy projects require approval from the Ministry of Energy.

Foreign investment must be remitted through authorised banking channels, accompanied by proof of foreign currency conversion obtained from your bank.

Benefits of Completing Proper Registration Through CAMIS

The CAMIS platform offers numerous advantages, including faster processing times through online submission and automated workflows, transparency through real-time application tracking, reduced physical visits to government offices, secure digital document storage accessible whenever needed, and integrated processes that connect with other government systems, such as the IRD portal.

Conclusion

The company registration process in Nepal has been substantially modernised through the CAMIS platform.

By following these detailed, point-wise steps, you can navigate the registration process efficiently and establish your company on a solid legal foundation. Whilst the process requires mindfulness and compliance with various requirements, the online system has made company formation more accessible than ever before.

Taking the time to understand each step, preparing documentation carefully, and responding promptly to any queries ensures a smooth registration experience, which in turn opens the door to legitimate business operations, legal protections, and growth opportunities in Nepal’s developing economy.