If you are applying for a loan or chasing the dream of studying abroad, chances are you will be asked to provide a salary certificate in Nepal.

Whether it is a bank, a foreign embassy, or a government office, they all want proof that you have a stable income. But what exactly is a salary certificate? And why is it so important?

At first glance, a salary certificate in Nepal might seem like just another piece of paperwork, however, it serves a much bigger purpose, and it is a trusted document confirming your employment and employee income.

For institutions, it is a tool to assess financial credibility and verify that you can meet obligations, such as repaying a loan or supporting yourself in another country.

In Nepal, salary certificates hold significance beyond individual use, as they are linked to the nation’s labour laws, notably the Labour Act 2074 (2017), which outlines employers’ obligations and employees’ rights regarding salary documentation and transparency.

What Is a Salary Certificate in Nepal?

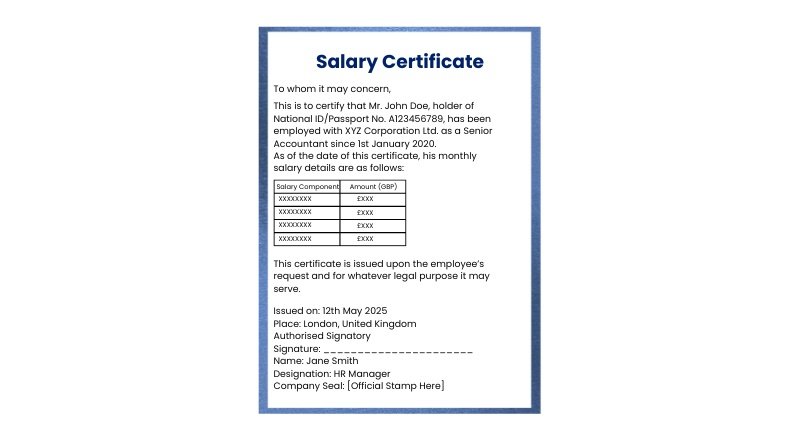

A salary certificate is an official document provided by your employer, verifying your job status and detailing your monthly earnings. It serves as a report card for your salary. Whether you are an employee or an employer in Nepal, a salary certificate in Nepal may seem like a minor document, yet it holds considerable importance.

It is more than a mere formality; it serves as your official income verification and is vital for financial transactions, legal matters, and even applications abroad.

What Does a Salary Certificate Include?

A salary certificate in Nepal provides a clear snapshot of how much you earn, what deductions are made, and what you actually get at the end of the month.

Here are some of the common factors that are found in a salary certificate:

- Basic Salary – This is your basic income, a fixed amount you earn before any bonuses or extras and does not include any allowances or incentives.

- Allowances – The allowances are additional benefits provided on top of your basic salary and can vary depending on your company’s policies and your role. It will include housing, transport or fuel, meals, and medical or communication allowances.

- Deductions – In human nature, they do not love deductions, but deductions are necessary as part of the salary process. Some amounts subtracted from your total salary include taxes, social security contributions, provident fund deductions and insurance premiums if applicable.

- Net Salary – When all the deductions are made, the remaining amount is your net salary, the actual money that lands in your bank account.

Why Is a Salary Certificate Needed?

Whether you are an employee looking to prove your income or an employer trying to stay compliant, salary certificates in Nepal play a vital role in making financial and legal processes smoother, more transparent, and properly documented.

Here are the key areas of the salary certificate needed for both employees and employers:

For Employees

- Loan Applications – If you are planning to buy a dream house, car, or need a personal loan, you must provide proof of your income before they approve any loan. A salary certificate in Nepal shows exactly how much you earn, giving banks the confidence that you have the means to repay the loan.

- Tax Filing – Filing taxes is stressful for everyone. Still, you have a salary certificate, which can reduce that stress because it outlines your total income, deductions, and contributions, making the tax filing process more reliable and hassle-free.

- Visa Applications – If you are heading abroad for better work or education, embassies and consulates often need to verify your financial stability, and you have a salary certificate, which is one of the trusted documents to show that you can support yourself during your stay overseas.

- Claiming Employee Benefits – If you have your salary certificate, it may help to claim various employee benefits, such as Social Security Fund (SSF), gratuity payments, festival allowances or bonuses, and get all you are legally entitled to.

For Employers

- Avoiding Penalties and Legal Trouble – Failure to provide proper salary documentation may lead to penalties or legal consequences. Issuing accurate and timely salary certificates can save you from unnecessary headaches down the road.

- Legal Compliance – In accordance with Nepal’s Labour Act 2074, employers are mandated to maintain reliable records of employee compensation and salaries. The salary certificate ensures that all the essentials for minimum wage, deductions, and contribution rules are met accordingly, helping to stay compliant with the law.

- Transparent Recordkeeping – Filing salary certificates builds trust, maintains transparency between employees and employers, and shows that the company is well organised, fair, and accountable. In addition to any disputes related to the salary, it will help settle disputes quickly and legally.

How Are Salary Certificates Relevant to the Labour Act 2074?

When looking up at Nepal, the Labour Act 2074 provides the legal foundation for fair compensation and transparent employment practices. While the Act does not mention the term ‘salary certificate,’ it outlines the requirements for creating a legal and practical need for salary documentation.

Let us discover how different sections of the Labour Act, 2072, underscore the importance of issuing salary certificates.

Fair Pay and Timely Payment (Sections 34 & 35)

Sections 34 and 35 of the Labour Act focus on ensuring that employees are paid fairly and promptly.

Section 34 mandates that all employees receive at least the minimum remuneration prescribed by the Government of Nepal.

Section 35 outlines the payment timeline for employees, based on their types of employment. Short-term workers should be paid within three days of completing their work. Casual workers must receive payment immediately after finishing the job. Regular employees must be paid monthly, within a set deadline.

Although the Act does not specifically mention salary certificates, having one helps document that payments were made properly and on time, supporting legal compliance and transparency.

Annual Salary Increments (Section 36)

According to Section 36, employees are entitled to a yearly salary increment after completing one year of service. The increment is calculated at half a day’s salary for each year worked, ensuring compensation keeps pace with time and loyalty.

To comply with this requirement, when updated properly, a salary certificate in Nepal serves as an official record of these increments, enabling employers and employees to track salary growth over time.

Social Security Contributions (Social Security Act 2074)

In addition to the Labour Act, the Social Security Act 2074 requires employers in Nepal to make monthly contributions to the Social Security Fund (SSF) based on each employee’s salary. Maintaining proper salary records is essential since these contributions depend on accurate salary figures.

As a result, salary certificates in Nepal are important for income verification and crucial for ensuring legal compliance with Nepal’s social security system.

Conclusion

A salary certificate in Nepal may seem like a simple document, but in Nepal, it holds significant legal and practical value. Whether you are an employee needing proof of income for a loan or visa, or an employer seeking to comply with the Labour Act 2074 and Social Security Act, this document plays a crucial role.

It ensures transparency, supports legal compliance, and streamlines financial and employment-related processes for all parties involved.